The Utica Shale Play

The Utica Shale was discovered recently by the U.S. Geological Survey (USGS) and although it ranks third in size when compared to the Marcellus Shale in the eastern United States and the Green River Formation found in Colorado, Wyoming, and Utah, the Utica Shale is estimated to have larger reserves of natural gas, oil, and other natural gas liquids. In fact, the USGS estimates the Utica Shale contains close to 38 trillion cubic feet of natural gas, 940 million barrels of crude oil, and nine million barrels of gases such as ethane and propane. However its size isn’t the only thing driving up speculation regarding the U.S.’s potential of becoming the leader in oil production.

What is special about the Utica Shale?

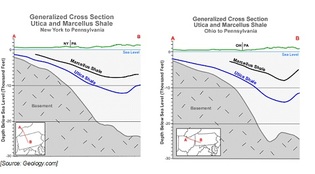

The Utica Shale is unique because of its location to the surface. Although the Utica Shale is located directly under the Marcellus Shale which sits at approximately 5000 feet below the earth’s surface, in areas such as New York and Ohio, deposits are found at a mere 2000 feet below the surface. This means lower drilling and production costs which has a major impact on the United States ability to produce more oil. In addition, the quality of some test wells suggest that the crude oil products will be a premium light sweet crude.

The U.S. has five other Shale Plays aside from Marcellus and Utica. They are: The Bakken Formation, Barnett Shale, Eagle Ford Shale, Haynesville Shale, and Niobrara Shale.

The Bakken Shale extends from eastern Montana into western North Dakota. It is estimated to have 3.65 billion barrels of oil, 1.85 trillion cubic feet of dissolved natural gas, and 148 million barrels of natural gas liquids.

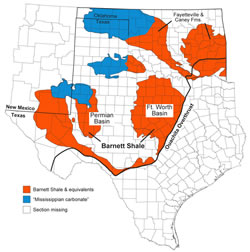

The Barnett Shale, located in northeast Texas has been a major source of oil production for over 50 years and until recently was thought to be tapped out. However over the last few years, the Barnett Shale has produced more natural gas than any other shale play in Texas. It produces 1.5 billion cubic feet per day of natural gas and is expected to increase over the next decade as more wells are being drilled.

The Eagle Ford Shale, located in southern Texas, produces both natural gas and oil. A 2012 report from the USGS estimates that there is a mean average of 1 billion barrels of oil, 52 trillion cubic feet of gas, and 2 million barrels of natural gas liquids undeveloped but recoverable from the Eagle Ford Shale.

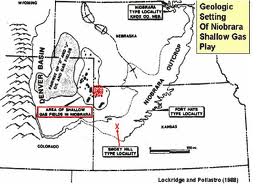

The Niobrara Shale extends through five states; Colorado, Wyoming, Montana, South Dakota, and Nebraska. At one point Niobrara was being compared to the Bakken Formation in regards to its undeveloped resources. The Niobrara consists of three major basins; North Park, Powder River, and Denver-Julesberg (D. J. Basin). USGS estimates for just the Powder River basin include 16.5 trillion cubic feet of gas, 1.5 billion barrels of oil, and 86.5 million barrels of natural gas liquids.

Location, location, location.

Many of these new reserves are not in the traditional location of earlier oil and gas reserves. The midstream infrastructure will change significantly as these resources are developed. Just some examples are the plans to change direction in the product flow of Enterprise's Seaway crude oil and TEPCO propane pipelines. Other significant projects to tap into these new locations will come on line in the next two to ten years. The Utica Shale is perhaps the most interesting as it is very close to the highly populated Northeast Corridor.

Can the U.S. Compete with Saudi Arabia?

The United States is sitting on close to 200,000 trillion feet of undiscovered gas, over 1,000 billion barrels of oil, and close to 2500 million barrels of natural gas liquids. So why is Saudi Arabia currently the world's leader in oil production? It's in the cost of production. The cost of drilling is far cheaper in Saudi Arabia than the cost of drilling domestically in the United States. This begs the question whether the United States can supplant Saudi Arabia and become the leader in oil production. But the recent Shale discoveries, especially the Utica Shale discovery puts the United states closer to that goal and even closer to domestic autonomy from foreign oil.

What does this mean?

The benefits for the U.S. will be significant. Some economically depressed areas of the country will become affluent. Cheaper energy will drive down costs in every business and household budget. The country's economy will have a greatly reduced balance of payments deficit. And most importantly, there will be many unanticipated business opportunities in the changing energy landscape.

Sources:

Geology.com: Utica Shale - The Natural Gas Giant Below the Marcellus

CBS Money Watch: U.S. May Soon Become World's Top Oil Producer

Investment U: The Utica Shale: Get Ready For a Spout of Potential Gains

USGS.gov: Assessment of Undiscovered Oil.....

What does this mean for your business?

We have many tools to help you evaluate this trend in the petroleum markets as it applies to your business opportunities.

Here are but a few of our tools:

1. Mergers and Acquisitions

2. Succession Planning

3. Growth Initiatives

4. Restructuring, Turnaround, and Business Process Improvement

5. Finance and Development of Emerging Businesses and Industries.

Call or email one of our team:

Sean Cota:

Industry champion… Chief, cook, bottle washer! Sean has more than 34 years of experience in the retail fuels industry, serving as President of his family businesses in VT and NH until 2011. Sean is resident in our Washington, DC and Bellows Falls, VT Offices.

email: sean.cota@lakerudd.com

Phone: 802-380-1571

Bill Overbay:

Conductor…Mediator…and Referee! Bill has over 15 years of corporate financial experience ranging from venture backed start-ups. Bill is resident in our Providence, RI office.

email: boverbay@lakerudd.com

Phone: 401-286-4883

RSS Feed

RSS Feed